If you share in Arthritis Society Canada’s vision of extinguishing arthritis, there’s never been a better time than now to confirm your intention to leave a Gift in Will.

Throughout your life you’ve carefully planned for vacations, home purchases, retirement and even how your final wishes will be carried out. What if you could also plan to leave a lasting legacy for your family, while ensuring your loved ones’ futures are protected?

Leaving a meaningful legacy is in reach for everyone. As Cheryl “CJ” Johnson, a long-time volunteer, arthritis champion and donor says, “it’s important to give back to causes that speak to your heart.” Cheryl lives with three types of arthritis and is an inspiration to us all.

After ensuring that your loved ones are taken care of, please consider Arthritis Society Canada as a charity of choice for your estate giving and join our community of supporters who share our vision of extinguishing arthritis.

Contact us today to get started on your own legacy journey:

Charitable gift annuities

A charitable gift annuity is an attractive way for individuals aged 70 years and older to make a donation to Arthritis Society Canada while receiving a guaranteed income stream for life.

The benefits of charitable gift annuities:

- an increase in your current after-tax spendable income

- a fixed and guaranteed income stream, at a rate of return that is higher than that of GICs

- no investment management required once the annuity is set up

- a significant portion, if not all, of the income from a gift annuity is tax-free

- a charitable tax receipt for the donation component for even more tax savings

To request a quote, email [email protected].

Charitable Gift Annuities

A charitable gift annuity (or “Gift Plus Annuity) is an attractive way for individuals aged 70 years and older to make a donation to Arthritis Society Canada while receiving a guaranteed income stream for life.

The “Gift Plus Annuity” is an arrangement under which the donor transfers a certain sum to the charity subject to a Deed of Agreement which authorizes the charity, acting on the donor’s behalf and working through a life insurance agent, to arrange for a commercial annuity that would pay the amount stipulated by the agreement.

When to consider a Charitable Gift Annuity

A Charitable Gift Annuity may be a good investment to consider if:

- you’re 70 or older

- you’re looking for a worry-free investment

- you’d like to support Arthritis Society Canada now

- you’re in need of the income during your lifetime

- you’re looking for an alternative to GICs or other fixed income investments

- you’re willing to make a contribution of $10,000 or more

How it works

Charitable Gift Annuities are giving vehicles that offer the same income security as GICs, or other fixed income investments, but with better cash flow.

If you make an irrevocable gift to Arthritis Society Canada for a gift plus annuity, part of the contribution amount becomes an immediate gift to the Society for which you receive a tax receipt. The gift portion will be determined by you and the Society, but must be a minimum of 20%. The remaining funds are used by Arthritis Society Canada to purchase your annuity from a top-rated life insurance company.

You’ll receive a one-time Tax Receipt for the gift amount; and you will receive guaranteed income payments for life.

How you’ll benefit

- guaranteed income for life

- make a significant gift to Arthritis Society Canada

- receive a charitable tax receipt for the gift portion to the charity

- depending on your age, the annual income you receive from the annuity will be substantially, or entirely tax-free

- once your annuity is in place, the annuity rates are locked-in and guaranteed and do not fluctuate

- you’ll see your gift in action through Arthritis Society Canada during your lifetime

- Arthritis Society Canada handles all of the set-up for you as stipulated by the agreement

The annual income you receive from the annuity will depend on variables such as your age and the current rates. The older you are at the time of the annuity, the better your return. You can arrange for a single-life or a joint-life annuity with your spouse, with a last-to-die clause. A Gift Plus Annuity requires a minimum contribution amount of $10,000 with a minimum gift portion of 20%.

To receive a personalized quote from Arthritis Society Canada with no obligation, please email [email protected] the below information and a member of the planned giving team will get back to you.

- Property Type: Cash or securities

- Contribution Amount: (Note: the minimum is $10,000)

- Gift Amount: At Arthritis Society Canada our generous donors usually request a 25% gift amount. Quotes will be generated for 25% gift amount unless requested otherwise. Note: the minimum is 20%.

- Type: Single Life or Joint Life

- Names and Date of Birth of Relevant Parties

- Telephone Number

- Email Address

It is recommended that you seek independent professional advice when preparing or considering making a planned gift such as a Charitable Gift Annuity.

Forms and resources

Forms

Planning Your Will Guide [PDF]

Bequest Commitment Form [PDF]

Gifts of Public Securities [PDF]

Our Address:

Planned Giving Office

Arthritis Society Canada

220 Bay St, Suite 300

Toronto, ON M5J 2W4

A gift in your will is also known as a bequest or legacy

A person’s Will is more than a legal document. A Will is a testimony to a person’s life and values – values that have emerged from a lifetime of living, learning, work and growth. Giving consideration to a gift in your Will indicates a willingness to give real expression to the values which were important during a lifetime. An increasing number of Canadians as part of their estate planning are leaving a gift to charity in their Will.

Naming Arthritis Society Canada in your Will is a wonderful way to continue your support into the future. Bequests help ensure the continuation of access to arthritis education, programs and services for Canadians living with arthritis. They are also an integral part of funding research for a cure.The tax structure of our country is set up in such a way as to favour charitable giving. There are a number of ways of leaving a gift through your Will. Bequests can be in the form of cash, real estate, securities, tangible personal property or other assets.

Tax Benefits: A gift in your Will (also known as a bequest or legacy) gives your estate a donation receipt for the amount given and thus a tax credit to be used in your final tax return. It can be used against 100% of income in the year of death and any excess not used may be carried back one year and used up to 100% of income in the year before death.

Charitable registration #: 10807 1671 RR0003

A gift in your Will (also known as a bequest or legacy) is straightforward to arrange. It can be as simple as including a sentence or two when you write your Will, or adding a codicil to your existing Will.

There are different types of gifts you can leave in your Will:

- Specific bequest: a specified dollar amount, or a specific item of property, that is left to a named beneficiary in the Will

- Residual bequest: a percentage (or) share (or) all of the remainder of your estate after other gifts and liabilities have been paid out

- Contingent bequest: a percentage or share of your estate paid only in the event that other named beneficiaries have predeceased you

If you are thinking of leaving a gift to Arthritis Society Canada in your Will, download our sample wording for bequests. You can provide this sample wording to your lawyer for inclusion in your Will.

Need help planning your will?

Planning Your Will Guide

Download our easy-to-follow Planning Your Will guide. It will help you think about your estate – a first step in preparing for discussions with your family, your lawyer and other advisors.

If you have an existing Will, read over the below checklist to know if it’s time to review and update it. It is recommended that you review it every three to five years

Talk to your lawyer: Talk to your lawyer about what will work best for you. Once you have provided for your loved ones, the Arthritis Society would be honoured if you would consider naming Arthritis Society Canada as a beneficiary of your estate.

Checklist

If ANY are true, you would be wise to consider updating your Will:

- It has been three years or more since I last reviewed my Will.

- My Will was drawn up when I lived in a different province or country.

- There has been a birth in the family.

- There has been a death in the family.

- There has been a change in my marital status.

- The beneficiaries named in my Will are no longer living.

- I would like to add or remove beneficiaries.

- The executor and/or alternate named in my Will are no longer living.

- I would like to change the executor and/or alternate named in my Will.

- There have been changes in the value of my estate.

- I would like to change how I distribute my estate.

- My charitable giving plans have changed.

You answered that at least one of the above statements was true. Please consider downloading our Planning Your Will Guide. It will help you think about your estate – a first step in preparing for discussions with your family, your lawyer and other advisors.

A Will makes sure your assets are distributed quickly and in the manner you desire, and that your loved ones lose as little as possible to the tax man. Following are some estate planning strategies to consider:

- The core of any estate plan is a valid, up-to-date Will. Your Will legally establishes what you want done with your assets.

- If you die without a Will, your estate will be distributed according to the laws in your province of residence. And unfortunately, the results may bear little resemblance to how you would like to see your assets divided.

- To draw up an effective Will, it is wise to seek expert counsel. If you draft it yourself, you may inadvertently leave some areas open to challenge. Take the case of a woman who wrote in her do-it-yourself Will that she wanted all of her “cash” to go to her son. The Will was tied up for years as the courts tried to determine whether “cash” meant investments such as GICs.

- It is also important that your Will be up-to-date. The value of your assets will change over time, and you will probably acquire new assets as well as sell others. Your Will should reflect these changes. A Will should be reviewed with your professional advisor every three to five years and updated as necessary.

- You should always review your Will if there has been a major change in your life, such as a marriage, divorce, or birth of a child.

Once you have made your Will, does your family know:

- Where your Will is located?

- Name & address of your Executor?

- Name & address of your accountant?

- Name & address of your lawyer?

- Name & address of your life insurance agent?

- Where your life insurance policies are located?

- Where you duplicate tax returns are located?

- Where the house or cottage deed is located?

- Where your valuables and legal documents are located?

- Where the key to your safety deposit box is kept?

- Where your safety deposit box is located?

“Planning takes a little time, however, the time spent will give you and your family peace of mind.”

-Colleen Bradley, President, Planned Giving Solutions Inc.

Please tell us about your gift

If you have left, or intend to leave, a gift in your Will to Arthritis Society Canada, please let us know. Download our Bequest Commitment Form [PDF].

Letting us know of your gift will help to ensure that the funds will be used in the way that you intend. We would also like to thank you personally for your future gift! Your information will be kept completely confidential.

Gift of securities

Other giving options

A gift of life insurance

A gift of life insurance is an affordable way to make a significant future gift to Arthritis Society Canada.

You may name Arthritis Society Canada as the beneficiary of a new or existing life insurance policy. A tax receipt will be issued to your estate for the full amount of funds distributed upon your death. These funds are not subject to probate, as they are separate from your other estate assets.

If you plan on taking out a new life insurance policy, consider naming Arthritis Society Canada as owner and beneficiary. In this way, you will receive annual tax receipts for the yearly insurance premiums.

You may also transfer ownership and beneficiary designation to Arthritis Society Canada of any existing partially or completely paid-up policies, if these have finished serving their original purposes. You’ll receive a tax receipt for the cash value, and tax receipts will also be issued annually for the future premiums you pay on the policy.

The benefits of gifting life insurance are:

- tax savings today

- your estate is not diminished to your heirs (because life insurance, by its nature, creates a separate “estate”)

- it is not subject to probate fees or delays in settlement – the full proceeds are payable to Arthritis Society Canada at maturity or death (probate fees do not exist in Quebec)

- you can plan, arrange and announce the gift yourself and you will know that it will occur just as you planned

- it is not a matter of public record; it cannot be contested, unlike a Will

How to make a gift of life insurance

We recommend that you discuss your gift intentions with a life insurance agent and your financial planner. They can help you determine which type of insurance best suits your needs. When you are ready to proceed, get in touch with our Planned Giving team. We’ll be pleased to assist you in completing your gift.

A gift of retirement funds

RRSP or RRIF

You may wish to leave to Arthritis Society Canada some or all of the funds in your Registered Retirement Savings Plan (RRSP) or Registered Retirement Income Fund (RRIF). It’s as simple as naming Arthritis Society Canada as a beneficiary.

Distribution of your RRSP or RRIF funds will be made to Arthritis Society Canada and other named beneficiaries separate from the remainder of your estate and will not be subject to probate.

Your estate will receive a tax receipt for the full amount of the funds distributed to Arthritis Society Canada.

This tax credit can be applied to the taxable income on your terminal tax return.

How to donate retirement funds?

Contact your investment advisor or the financial institution holding your retirement funds. They will provide you with a beneficiary form to fill out and return to the institution.

Charitable remainder trusts/Gifts of residual interest

If you have cash or an asset that you have considered leaving to Arthritis Society Canada in your Will but would like the tax benefit now, then a charitable remainder trust or a gift of residual interest may be your answer.

Trusts

Trusts protect assets and ensure that a designated beneficiary will receive them upon your death. You would be entitled to all the income generated within the trust during your lifetime. A lawyer can set up a trust for you.

There are different types of trusts:

- Capital remainder trust – the capital within the trust must remain intact during the donor’s lifetime.

- Charitable remainder trust – can only name a charity as a beneficiary (as opposed to an alter ego trust, which can name other beneficiaries as well). The charity issues a tax receipt for the discounted present value of assets transferred to a charitable remainder trust. The tax credit from this receipt can be used to offset current income. Any unused portion can be carried forward five years.

The trust is the owner of any of its assets. (The individual establishing the trust does not own the assets, so these cannot be included in a Will.) The trust and its assets are not subject to probate and probate fees. The trust also protects against Wills Variation Act claims. Privacy is another advantage of trusts, as they do not become publicly filed documents.

The transfer of an asset that has increased in value since it was purchased will trigger capital gains tax at the time of its transfer to a trust, unless the donor is 65 or older. A person who is 65 or older can transfer assets to an alter ego trust without triggering gains so long as he or she is the only person entitled to the income and capital of the trust during his or her lifetime.

Gifts of residual interest

A gift of residual interest allows you to donate an asset today (personal residence, work of art, investment property) to Arthritis Society Canada, and enjoy the use of it for the rest of your life. A tax receipt is issued for the fair market value of the donated asset. The allowable tax credit is based on the cash amount or market value of the property, your age, and current interest rates.

How to arrange a trust or a gift of residual interest

Discuss your gift intentions with your lawyer, financial advisor or tax advisor. Then you or one of these experts representing you can contact the Planned Giving team to arrange these gifts. Arthritis Society Canada should be consulted well in advance of establishing a charitable remainder trust or a gift of residual interest to discuss terms and conditions required for acceptance and receipting.

Stories

Including Arthritis Society Canada in your Will is a meaningful way to invest in cutting-edge research and fund essential programs and services for future generations. After ensuring that your loved ones are taken care of, you can designate a percentage of the residual of your estate to help create a future free from the devastating effects of arthritis.

To get started on your own legacy journey, email Liesl at [email protected] or call 1-844-979-7228.

Cheryl's story

“It’s important to give back to causes that speak to your heart.” ~ Cheryl Johnson, legacy donor and volunteer

“It’s important to give back to causes that speak to your heart.” ~ Cheryl Johnson, legacy donor and volunteer

When I was at my weakest and most vulnerable, learning to cope with three types of arthritis, and being told that I would be wheelchair bound for the rest of my life, people from the Arthritis Society lifted me up. They encouraged me to become a volunteer and use my experiences to help others who are struggling.

I decided to leave a gift to the Arthritis Society in my Will so that the vitally important work that they’re doing will continue. I know my contribution will be directed to where it can make the maximum impact and help the most: supporting people affected by arthritis and funding research to one day find a cure. I am also confident that this organization is fiscally responsible.

It’s important for me to leave something behind. I hope you will join me in giving the gift of a lifetime.

Lilly's Legacy

“Your mom was such an interesting combination of being spiritual and yet practical. Her faith was profound. She trusted that God would get her through every trial. At the same time she was a realist, insisting on finding the truth in every situation, delighting in the world around her.”

– Rev. Helene Burns

Jegasothy “Lilly” Jesudason moved to Canada in 1966, with her husband and young family. Originally an immigrant of Sri Lanka, she was the primary caregiver at home. Along with the usual (labour intensive) traditional cooking, cleaning, laundry, ironing, and taking care of the entire family, she shoveled snow, took out the trash, and drove her kids everywhere. In addition to all of the above, she took to woodworking and sewing! She built shelves, backboard for tennis/basketball, sewed school and Halloween outfits for her kids and did substitute teaching as well! We remember how our Mom would awake every morning at 6:30, cook several curries, then get breakfast for us all, clean the entire home, get groceries, run errands and still help us with our homework! Not a day went by that she did not do it all. In her forties, however, this amazing superwoman was in excruciating pain. The same woman, who built a tennis backboard and re-did the downstairs bathroom, now could not even button her blouse.

Jegasothy “Lilly” Jesudason moved to Canada in 1966, with her husband and young family. Originally an immigrant of Sri Lanka, she was the primary caregiver at home. Along with the usual (labour intensive) traditional cooking, cleaning, laundry, ironing, and taking care of the entire family, she shoveled snow, took out the trash, and drove her kids everywhere. In addition to all of the above, she took to woodworking and sewing! She built shelves, backboard for tennis/basketball, sewed school and Halloween outfits for her kids and did substitute teaching as well! We remember how our Mom would awake every morning at 6:30, cook several curries, then get breakfast for us all, clean the entire home, get groceries, run errands and still help us with our homework! Not a day went by that she did not do it all. In her forties, however, this amazing superwoman was in excruciating pain. The same woman, who built a tennis backboard and re-did the downstairs bathroom, now could not even button her blouse.

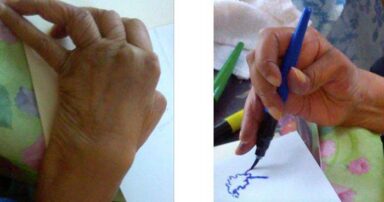

Over the decades her feet and other parts of her body suffered the effects of rheumatoid arthritis. The medications used to treat this disease also came with severe side effects. Soon she dealt with weight gain/loss, shortness of breath, fatigue, some hair loss, and eventually the arthritis flare ups. Older medication used for treatment lead to lung damage. She was eventually diagnosed with advanced interstitial lung disease. Life was hard, yet Lilly persevered. She took pride in cooking full traditional meals, even for her now adult children, whenever possible, still did groceries and cleaned the entire house daily. However, the disease, in combination with medication side effects, took its toll. She needed help doing the most basic things. She tried at least 8 different kinds of treatments including gold injections, Finally, in her 80’s, she tried a treatment that was intensive, but finally seemed to keep her arthritis at bay. However, by this time her interstitial lung disease and arthritis was so severe that her hands looked like this:

Of her ten fingers only two on each hand were functional. Still she did as much as she could on her own, though dependent on the help of others. Even though her new medication seemed to slow down the effects of arthritis, the interstitial lung disease progressed. Had newer medications, with less side effects, been available earlier, and had she been diagnosed and monitored earlier, she could have maintained her independence and quality of life much longer. She will always be “Mom” to us and to many others. Research into finding ways to treat this horrific and painful disease is so important to keep wonderful people, like our Mom, at their best – independent and productive.

We saw our mom go through excruciating pain and suffer without treatment for many years. We saw her lovely fingers and joints become deformed. It is difficult recognizing the obstacles that people with rheumatoid arthritis go through yet persevere. Today, we realize how our mom’s strength and determination to see a difficult job through to its completion inspires us and everyone she touched in her lifetime. These are great lessons to live by.

If arthritis has touched you or your loved ones the way it has touched ours, we encourage you to make a gift in their honour to the Arthritis Society, or a legacy gift in your will to the Arthritis Society. It’s a gesture of generosity which helps to keep their memory alive.

Perhaps your generosity will give others extra years with their loved ones – and you can’t put a dollar value on that!

If Lilly’s story inspires you please give now for arthritis research!

Returning the favour

Dr. Raymond Lam and Alanna Wong remember their sister, Joyce Lam, as head-strong and resilient. These were traits that served her well as she wrestled with arthritis for most of her life.

“She was always a fighter,” says Raymond. “For a lot of her life, Joyce had this condition, but she never let it define her. She always looked to do whatever she wanted despite any physical limitations. That was the type of person she was.”

A grateful fighter, one could say. Joyce, who passed away at age 63 in April 2022 after arthritis had caused severe damage to her heart and lungs, received support from Arthritis Society Canada throughout her life. The Vancouverite left the organization a gift in her Will to help change the future for people impacted by arthritis.

The miracle of medicine

Joyce had a complex condition that presented when she was in university. Initially, she was diagnosed with lupus, and later mixed connective tissue disease. Arthritis, however, was always part of the clinical picture.

Joyce had a complex condition that presented when she was in university. Initially, she was diagnosed with lupus, and later mixed connective tissue disease. Arthritis, however, was always part of the clinical picture.

Her health deteriorated rapidly in her mid-twenties as the disease attacked her heart and lungs, and she eventually was admitted to an intensive care unit. Raymond, a professor of psychiatry at the University of British Columbia, was away doing his training when this happened. He made an emergency trip home to see her.

“She was on death’s doorstep. Her doctors didn’t think she’d make it,” he recalls.

As Joyce fought for her life, she participated in a clinical trial of a new medication. The results were beyond anyone’s wildest expectations.

“She got so much better during that clinical trial. Her heart and lungs stabilized – she was well! It was a miracle,” Raymond says. “Even though the medication showed mixed results overall in the trial, it worked for her. It was one of those unexpected results that can sometimes happen in medicine that no one could have predicted.”

Planting a seed for future generations

Thanks in part to the trial medication and the care of her doctors, Joyce lived more than 30 years longer than expected. She still had arthritis and other medical issues, but she lived well. Throughout those three decades, she relied on Arthritis Society Canada’s support.

Thanks in part to the trial medication and the care of her doctors, Joyce lived more than 30 years longer than expected. She still had arthritis and other medical issues, but she lived well. Throughout those three decades, she relied on Arthritis Society Canada’s support.

When she was diagnosed, Arthritis Society Canada’s B.C. Division shared information about the disease so Joyce could understand what she was facing. The organization taught her how to cope with arthritis, lent her helpful assistive devices and connected her with peer support programs. In return, Joyce volunteered – she took calls on the Arthritis Answers Line, talking people through a new diagnosis and offering a comforting voice of reassurance. The gesture carried extra meaning coming from someone with lived experience.

“Arthritis Society Canada was important to Joyce. It helped her to stay independent,” says Alanna. “That’s why she volunteered, and why she wanted her gift in Will to directly help patients impacted by arthritis access the much-needed support they might not be able to afford themselves.”

Alanna adds that research was of particular interest to Joyce. Because she benefitted greatly from a clinical trial, she promoted research and wanted to help establish new and better treatments.

In 2004, Arthritis Society Canada’s B.C. Division helped to start a fund in Joyce’s name at the Vancouver Foundation. It supports the creation of new programs and services to help reduce pain and disability for people living with the disease. Joyce planned for her estate gift to go directly into the fund, ensuring Arthritis Society Canada would receive quarterly annual income installments from it when she passed.

“Joyce was an incredibly special person,” says Liesl Drayton, Director, Planned Giving, Arthritis Society Canada. “She was passionate about advocating for the six million people in Canada living with arthritis, and this very generous gift will help to ensure her legacy lives on for years. We are deeply grateful.”

As Raymond and Alanna paint a picture of their “spunky and playful” sister, they touch on her love of cycling, her nieces and nephews, her dog and her husband, Tom. They also circle back to her interest in supporting Arthritis Society Canada and dispelling myths around the disease.

“Ordinarily, arthritis is seen as a condition of the older person. Because Joyce was young and vigorous, she could challenge that,” Raymond says. “She was an ambassador for Arthritis Society Canada, but the organization was really good for her, too, in that it offered her a way to give back and help others with the same condition.”